Imminent sale of Barnet Market car park: A site perhaps for another town centre housing scheme

After remaining empty and disused for the last four years, a buyer has finally been found for the abandoned car park that was once the home of Barnet Market — and what was for a brief time due to have become the site of a Premier Inn.

Agents Cushman and Wakefield – who specialise in residential development land transactions – say contracts have been exchanged and are due for completion later in August.

There is no word so far on the purchase price or any hint about future plans for the site.

But another residential development seems most likely given the number of new housing schemes under construction in and around Barnet town centre.

For some months there was speculation that there had been an offer of around £3 million to purchase the land to build new houses and flats but it then emerged the site was back on the market.

For the last few years there have been complicated twists and turns over the ownership of the car park – and currently it is owned by Aberdeen City Council through control of its finance company, Aberdeen Standard Investments.

In 2018, Locate Developments (Hotels) Ltd obtained hotly contested planning permission to build a Premier Inn.

But the scheme became a casualty of the covid-19 pandemic and the resulting wipe-out in bookings for hotel accommodation.

Locate’s planning approval for the hotel – which was due to have opened in time for Christmas 2020 – expired in November 2021.

But in April 2019, five months after gaining planning permission, Locate sold the site to Aberdeen City Council for £4 million, which now seems far higher than its current valuation for residential development.

Much to the anger of neighbours, residents and shoppers, the former car park has been closed to vehicles for the last four years and it has been a constant reminder of the loss of Barnet Market – an equally sad saga.

What was previously a cattle market, became a stalls market for vegetables, meat, and household goods in 1959 and its popularity was never in doubt for the next 40 years.

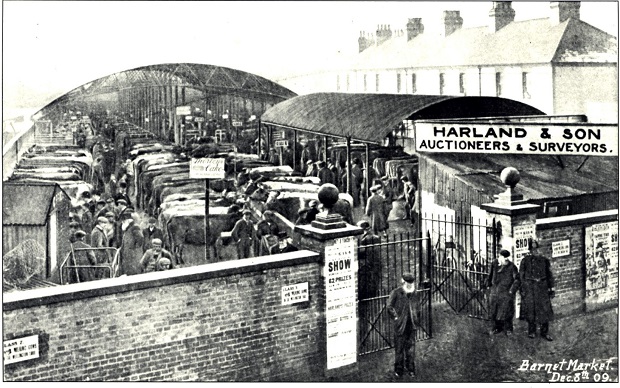

It was in 1999 that the future of the market started to change. William Harding Young of auctioneers and surveyors Harland and Son, the market’s long-standing operators, sold the site to Nigel and Melanie Walsh in a sealed bidding sale.

There were ill-fated plans to redevelop the site with a block of 14 flats with a stalls market at ground floor level and a basement car park.

Clearance of the site in started in 2008 and this required the market to move to a temporary site on Stapylton Road car park, but the project failed to proceed because of a lack of finance and the market returned to St Albans Road in November 2009.

In 2011, Mr and Mrs Walsh sold the site to the Swiss bank UBS Triton which had already purchased the Spires shopping centre. UBS developed plans to extend Waitrose supermarket and build a three-storey anchor store in the eastern courtyard.

However, that possibility receded when the property group William Pears became the new owners of the Spires in April 2013, and the expansion plans were dropped.

Pears inherited the marketplace and one of their first initiatives – which was greeted with a chorus of approval from groups such as the Friends of Barnet Market and the Barnet Society — was to announce that the St Albans Road site would be resurfaced and up graded at a cost of £100,000 and that other than on market days it would become a car park.

Ownership of the marketplace then passed to the Edinburgh based company, Locate Developments (Hotels) Ltd, which applied for planning permission to build the Premier Inn for Whitbread.

After strong feelings were expressed both for and against the proposed Premier Inn, the plan for a 100-bed hotel and restaurant was finally approved in November 2018 – but approval that was limited to three years.

Barnet Market was relocated to the bandstand area at the Waitrose end of The Spires shopping centre – a site that is rather restricted.

There has been pressure from the market traders for the site to be expanded to take in the area on the other side of The Spires’ service road, but the owners, BYM Capital, have given no indication of their future plans.

1 thought on “Imminent sale of Barnet Market car park: A site perhaps for another town centre housing scheme”

Comments are closed.

The proposed opening date of the Premier Inn by Christmas 2020 was as stated prior to the emergence of Covid in March 2021. No work had been done on the site or seemingly little on on paper since the mid 2018 application was approved. The exception was offloading the property to the hapless Aberdeen City Council with a 25 year lease of open land to the west of the Spires carpark. That area marked for parking just seven vehicles was to have been the previously unspecific but promised facility to ensure the 102 room motel without a carpark didn’t swamp the area overnight.

During that application financial media speculated, accurately as it turned out, that Whitbread were only pursuing applications for 10,000 new rooms to placate predatory investors and were unlikely to complete most of them. I predicted correctly those would include the High Barnet project.

That the scheme was either dead or like Monty Python’s mythical dead Norwegian Blue Parrot had never been real should have been apparent to everyone since March 2020. People still argue over whether a hotel would have been good for the town. I still hear the increasingly imaginative and demonstrably mis–sourced predictions for financial benefit to the town presented during the application.

It was merely a dream sold to some of us for other people to make money from an irreplaceable heritage asset. For several decades hotel operators had explored other options including reopening and extending the Red Lion’s hotel accommodation (spacious enough to have previously included two dance halls, banqueting facilities and a Masonic temple) but had concluded there would be insufficient demand for it.

In reality this milk was spilt years ago with the unexplained strangulation of the market from 50 stalls to five and the demolition of the Victorian market buildings, perimeter wall and gates that gave the Marketplace so much more historical character and authentic heritage than the soulless tarmac carpark of today. Whatever reasons were given this allowed a previously unthinkable change of use after the covenant insisting on a market being run on the site expired in 2014.

The land could now become another application for an increased height housing block. Alternatively it may be being bought as an asset of a land bank pending resolution of the current construction industry presumption that tower blocks can win planning permission anywhere on appeal if not at the town hall.

Whatever happens would have been inconceivable 25 years ago. We were suckered. Let’s be more careful with the valuable pockets of land still available in the town centre. Nobody is making any more of it.